Global trade has always relied on Asia’s extensive maritime network as a critical artery for goods moving between continents. From electronics and automobiles to everyday consumer products, the region’s ports and shipping lanes play a vital role in keeping global supply chains running smoothly. However, recent geopolitical tensions and ongoing disruptions have exposed vulnerabilities in Asia’s container gridlock, leading to cascading impacts on economies worldwide.

Rising Port Congestion Across Asia

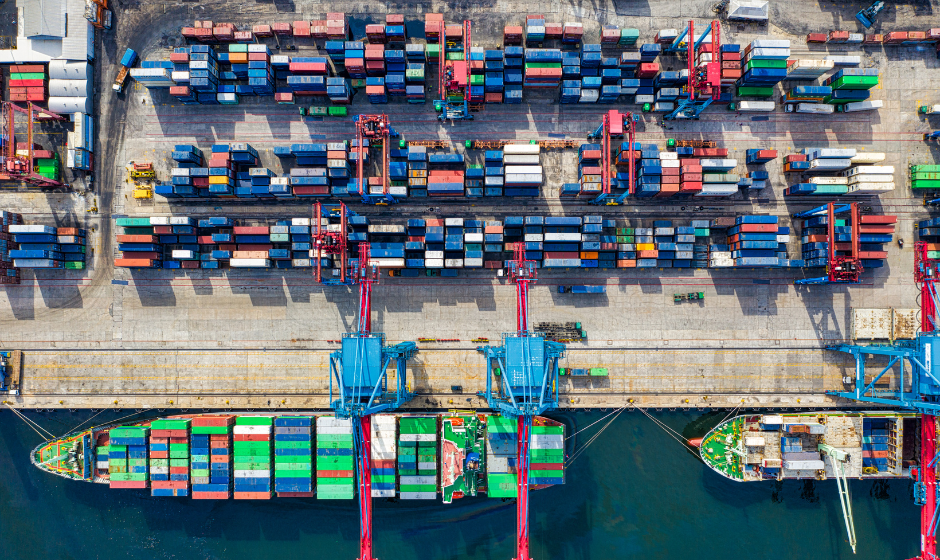

Over the past year, several of Asia’s busiest ports — including Singapore, Shanghai, Busan, and Hong Kong — have reported record congestion levels. Vessels are often forced to wait days, sometimes weeks, for available berths. This Asian port congestion is not solely due to increased cargo volume; it’s also driven by a combination of logistical bottlenecks, geopolitical conflicts, and shifts in trade patterns.

A shortage of labor, stricter customs inspections, and delays in vessel schedules have contributed to massive container pile-ups. Yard utilization rates in some terminals are reaching or exceeding capacity, creating ripple effects that stretch far beyond the region.

Geopolitical Tensions Reshaping Trade Routes

One of the primary drivers of current shipping disruptions is geopolitical tension in shipping routes. Ongoing maritime disputes in the South China Sea, the impact of sanctions and trade restrictions, and conflicts affecting key chokepoints like the Red Sea and Taiwan Strait have forced shipping lines to reconsider their traditional routes.

Many carriers have begun rerouting vessels to avoid sensitive waters, adding significant transit time and cost. For example, bypassing contested waters or areas affected by military exercises can extend shipping schedules by several days. These trade route disruptions in Asia not only slow down deliveries but also increase freight rates, insurance premiums, and operational risks.

Container Shortages Amplifying Gridlock

Compounding the issue is a persistent container shortage. During the COVID-19 pandemic, shipping containers became scattered across various ports due to imbalanced trade flows. Although global trade has recovered, many containers remain stuck at inland depots or congested terminals. This container shortage impact means exporters struggle to secure the boxes needed to move goods, leading to delays in manufacturing and delivery.

Carriers have responded by repositioning empty containers, but the slow turnaround times at congested ports make this process inefficient. The result is a vicious cycle: fewer available containers mean slower exports, which in turn worsen congestion.

Global Trade Disruptions Ripple Through Supply Chains

The consequences of Asia’s maritime trade infrastructure strain are being felt far beyond the region. Europe and North America are experiencing supply chain delays from Asia, with retailers and manufacturers facing longer lead times and higher transportation costs. Industries that rely on just-in-time inventory systems — such as automotive and electronics — are particularly vulnerable, as even minor shipping delays can disrupt entire production lines.

Freight rates have also surged. Spot rates for Asia–Europe and Asia–U.S. routes have more than doubled compared to pre-crisis levels, squeezing profit margins for businesses and ultimately raising costs for consumers.

Infrastructure Struggles to Keep Up

Asia’s maritime infrastructure has been under immense pressure for years. While ports like Shanghai and Singapore have invested heavily in automation and expansion projects, many other regional ports lack the capacity to handle sudden surges in volume. The current shipping bottlenecks in Asia have highlighted the urgent need for more resilient logistics systems, including modernized port facilities, digital tracking tools, and better coordination among regional governments.

Additionally, inland transport networks — including railways and trucking systems — are often ill-equipped to manage cargo overflow during peak periods. This mismatch between sea and land logistics capacity further slows container movement.

Adapting to a New Normal in Global Shipping

Shipping lines, logistics companies, and governments are taking steps to adapt to this evolving situation. Some carriers are deploying larger vessels or increasing sailing frequency to clear backlogs. Others are exploring alternative trade routes through emerging ports in Southeast Asia, aiming to diversify away from traditional chokepoints.

Governments are also playing a role. Regional forums have increased discussions on improving maritime cooperation and crisis response mechanisms. However, geopolitical tensions — such as rival territorial claims and strategic rivalries — complicate these efforts.

Looking Ahead: A Call for Resilience

The current logistics challenges due to geopolitical tensions underline a key reality: global trade can no longer rely solely on efficiency; resilience is equally important. For Asia, strengthening maritime infrastructure, diversifying port usage, and enhancing diplomatic coordination will be crucial steps to prevent future gridlocks.

For businesses, the situation is a reminder to build flexibility into their supply chains — through diversified sourcing, strategic inventory reserves, and closer collaboration with logistics partners. The container gridlock may not disappear overnight, but proactive strategies can help mitigate its most damaging effects.

Conclusion

The container gridlock in Asia represents more than just a temporary shipping headache; it is a symptom of deeper structural and geopolitical issues. As global trade disruptions continue to unfold, addressing these challenges will require coordinated efforts from governments, industry players, and international institutions.

Without decisive action, maritime trade infrastructure strain could become the new normal — with lasting consequences for the global economy.